The Israeli taxation system is characterized by a complex and multifaceted structure, a good understanding of which will help to avoid serious problems with tax agencies, simplify the process of paying income or business taxes.

The article describes the basic information about Israeli taxation, the advantages of every tax category: PIT, value added tax, business taxes, RET and national insurance.

Israeli Taxation System

The tax residency principle is the basis of taxation in Israel. This fact means that people who reside in the territory of the country for more than half a year are required to pay taxes on profits from any sources. It is the duty of citizens to provide a mandatory report to controlling organizations on sources of income in Israel and abroad.

Non-residents of Israel must pay taxes only on income earned within the state, they needn’t declare profits from foreign sources. Israel has a two-tier tax system: money received by the state from citizens is sent to state and local budgets. This makes it possible to raise the efficiency of using public money, because part of it immediately goes to local budgets. The National Insurance Agency is the main part of Israeli taxation. The formation of the insurance fund of citizens occurs due to regular deductions from their salaries and / or part of the individual entrepreneurial activities.

Key Tax Categories in Israel

There are 5 key categories of taxes in Israel: income tax, business tax, value added tax, real estate taxes, as well as mandatory insurance premiums.

Personal Income Tax

The Israeli Government has introduced a progressive tax scale in order to improve the efficiency of the country’s taxation system. Residents’ incomes are divided into active and passive. In the first case, we are talking about salaries and profits from making business. A passive part of income is generated by profits from securities and other financial assets. So that’s why, receiving dividends from government or corporate bonds is a passive income. Israelis over the age of 60 must pay tax at a rate of up to 31%. Only people who are employed or self-employed must pay a personal income tax.

As mentioned earlier, there is a progressive taxation scale in Israel, which distinguishes 7 levels. The minimum value of PIT is 10%, maximum reaches 50%. PIT levels in the Israeli taxation:

- up to 6790 ILS per month – 10%

- 6791 – 9730 ILS – 14%

- 9731 – 15620 ILS – 20%

- 15621 – 21710 ILS – 31%

- 21711 – 45180 ILS – 35%

- 45181 – 58190 ILS – 47%

- 58191 ILS and above – 50%

It is very advisable to comprehend that in the Israeli tax system of individuals, several levels of taxes can be applied at once. If the limit of one level is exceeded, the remaining income will be paid according to the tariff for a higher level.

Benefits for residents

Israeli tax residents can receive individual preferential units, which make it more profitable to pay taxes. Initially, all citizens receive them: 2.25 for men and 2.75 for women. It is important to note that some categories of persons can expect to receive additional units. These include parents with a child under the age of 1, having a child 1-5 years old, parents raising children alone, as well as citizens who have completed military service.

The profit that was received from the placement of funds in the “development fund” is exempt from taxes. The main condition for obtaining such a benefit is to have money in the account for 6 years or more from the moment they are deposited.

Benefits for immigrants and repatriates

Repatriates and Israelis of retirement age who decide to return to their homeland are exempt from paying taxes on foreign income for a period of 10 years. People who have just received Israeli citizenship may not pay taxes from bank accounts issued in foreign currency. Other categories of people are allowed to avoid paying taxes on foreign income for 5 years.

Benefits for qualified professionals

Some categories of professionals can use tax benefits in Israel. This applies to people who are professionally engaged in science, teachers, as well as experts in promising and sought-after fields. Within 1 year after entering the territory of Israel, they can receive a tax deduction for official rental of housing: private houses and apartments.

Non-residents in Israel, who have received an invitation to work in the country and have high professional skills, can officially obtain the status of experts by contacting the Investment Center under the government. After obtaining expert status, a non-resident will receive a tax limit of up to 25% for 3 years. It is important to note that the period of preferential taxation for in-demand specialists can be extended up to 5 years.

Corporate Tax

The basic corporate income tax in Israel is 23%, VAT is 17%. Enterprises with residency, as in the case of individuals, are taxed on profits earned worldwide, not only in the country. Non-resident companies must pay taxes on income which was earned from sources in the country. This system also applies to branches and subsidiaries.

There are several companies who have a special tax status that allows them to receive a preferential tax rate ranging from 0% to 23%. Large enterprises with income that is more than 10 billion ILS must be taxed at rates from 5% to 8%, depending on their location. Technology companies can receive a preferential rate of 6%.

Taxes for small businesses

Individual entrepreneurship in Israel is represented by 2 types of companies: Esek patur and esek murshe. The former don’t pay VAT, and the income ceiling is 108,000 shekels per year. Esek murshe requires a little more attention to financial reporting and must be registered as a VAT payer, but it doesn’t have an upper limit on annual turnover.

The tax rate is calculated when registering an enterprise with the Tax Office, and it can range from 10% to 46%. The declaration is submitted once a year, and taxes are due by April 30.

Taxes for innovative companies

For PFE, the corporate taxes rate is 7.5% when doing business in the “development zone A” and 16% in other cases. The tax on dividends for PFE is charged at the rate of 20%.

The SPFE mode is designed for very large corporations with a high proportion of investments in production assets, R&D or job creation. For them, the income tax rate is 5% in the “development zone A” and 8% outside it. The benefits are valid for 10 years, after which the PFE regime begins to apply.

With the SPTE format, the company must meet the same requirements as PTE, but have a total revenue of at least 10 billion. shekels. A reduced tax rate of 6% is applied to such enterprises, subject to approval by the Office of Innovation.

- Percentages. Interest income is taxed at a rate of 15%, provided that the underlying asset is not fully linked to the stock index. Otherwise, the 25% rate is applied. In addition, the rate may be changed in some cases – for example, when there is an employment relationship between the company and the seller.

- Dividends. Dividend income is taxed at a rate of 25% for an individual who is not the holder of the main block of shares. For large shareholders, the rate is 30%. The amount of tax can be reduced to 20% in accordance with the agreement on the avoidance of double taxation, or if a special tax regime or other financial incentive measures are applied to the company.

- Royalties. Royalties paid to resident legal entities and individuals are taxed at a rate of 20% if the recipient can prove that he keeps accounting records and has filed declarations; otherwise, the rate is 30%. Royalty payments to non-resident legal entities and individuals are taxed at the rates of 23% and 25%, respectively. The rate may be reduced under the terms of the agreement on the avoidance of double taxation.

Value-Added Tax (VAT)

VAT is a tax levied at every stage of the supply chain — from the manufacturer to the end consumer. In Israel, the standard VAT rate for 2024 is 17%, although reduced rates or tax exemption may apply for some categories of goods and services.

The principle of VAT is based on the fact that each company involved in the supply chain adds VAT to the price of its goods or services, and then transfers it to the state budget. At the same time, businesses are entitled to a refund of VAT paid by them when purchasing goods and services for their commercial activities.

VAT is required to be paid by all enterprises registered in Israel as Esek Murshe, as well as limited liability companies. This includes most small, medium and large enterprises, regardless of their field of activity.

Property Taxes

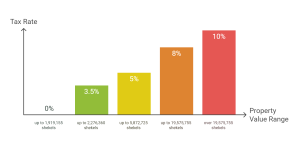

The tax on the purchase of real estate in Israel is called “mas rehisha”. Every year in January, new tax brackets are calculated: income thresholds from which one or another percentage must be paid. In addition, different tax rates apply to the purchase of the first and subsequent apartments. If the property is the only one, then the following calculations are applied to it, depending on the cost:

The tax on the purchase of real estate in Israel is called “mas rehisha”. Every year in January, new tax brackets are calculated: income thresholds from which one or another percentage must be paid. In addition, different tax rates apply to the purchase of the first and subsequent apartments. If the property is the only one, then the following calculations are applied to it, depending on the cost:

- up to 1,919,155 shekels – 0%

- up to 2,276,360 shekels – 3.5%

- up to 5,872,725 shekels – 5%

- up to 19,575,755 shekels – 8%

- over 19,575,755 shekels – 10%

In cases where the object being purchased is no longer the first, only 2 rates apply: 8% for real estate worth up to 5,872,725 shekels and 10% for the part that exceeds this threshold. Every property owner in Israel is required to pay a municipal fee – arnon. Its size is determined by the local authority, and depends on factors such as area, location, technical characteristics, and so on.

There is another type of housing maintenance tax: the ethel ashbaha, or improvement tax. It occurs if the house has received the right to be completed: for example, a closed parking lot or some other object. In this case, the value of the property increases, and when selling it will be necessary to pay the difference, which is 50% of the amount of the improvement made.

National Insurance

All Israelis, starting from the age of 18, pay a contribution to the National Insurance Agency, which consists of two parts: a health tax and a social security tax.

Contributions are collected at a progressive rate:

- For a portion of income in the amount of 60% of the average salary: 3.5% is paid by the employee, and 3.55% is paid by the employer

- For a portion of income exceeding 60% of the average salary: 12% is paid by the employee, and 7.6% is paid by the employer

The employee’s contributions are divided as follows: if he pays 3.5%, then 0.4% of them goes to the Department, and 3.1% goes to health insurance. When the rate is 12%, the contributions are distributed as 7% and 5% respectively.

Individual entrepreneurs pay contributions according to the following scheme: 3.1% of income not exceeding 60% of the average salary, and 5% for the remainder.

Taxation for Expats in Israel

Non-residents are subject to income tax on the same progressive scale as residents of Israel. All types of remuneration and benefits, both in cash and in kind, related to or arising from employment, are subject to taxation.

In particular, the income received by an expat will include:

- additional payment up to the subsistence minimum

- compensation for rental housing

- using a company car

- payments for a vacation trip to the homeland

- payment for children’s education and some other types of financial assistance

If a person without residency has received a salary for the work he has done abroad, then this income isn’t taxed.

A non–resident, if he received income in Israel, must file a tax return – except in cases where the tax was withheld from the source of income.

Israeli vs. US Tax Systems

The taxation systems in the USA and Israel have some significant similarities, as an example, in the peculiarities of paying personal earning tax or in the field of commercial taxation, as well as in some social benefits.

However, despite the initial similarities, there are a lot of tangible differences between the US and Israeli systems of taxation. That is why it is important for American immigrants to understand the advantages and peculiarities of the Israeli tax system well: a competent approach will allow them to receive many useful benefits when moving or returning to Israel.

FAQ

The main Israeli tax categories are income tax, national insurance, VAT, and real estate tax.

Active income is a citizen’s salary, as well as his profit from business. Passive income is the profit from owning various financial assets.

The mentioned principle divides citizens into residents and persons without tax residency. The former are obliged to pay tax from all sources of income, even foreign ones. People without residency must pay taxes on earnings made in the territory of Israel.