Taxation in Grenada is one of the main attractions of this amazing island state in the Caribbean. Its beaches, stunningly beautiful nature, and taxation laws are luring tourists and business people like a magnet. Here we are endeavoring to describe a number of features of Grenada’s taxation system, including some sorts of taxes the county has, some info on their rates, and, of course, the benefits available to both the residents and non-residents.

The tailored tax system of Grenada

This country employs a territorial taxation system. What this means in practice is that the Grenada taxes are accrued only on income earned domestically. This system is designed so as to ensure a balance between income and economic incentives in place to attract the investor. This taxing principle is used in the same way for residents and non-residents alike. Moreover, Grenada employs a well-developed set of benefits to stimulate domestic economic activity. Its unique Grenada Citizenship by Investment program is driving new investors and wealthy people in, thereby assisting the country’s economic progress.

Taxation of income for individuals

The government of Grenada has sought to develop and implement a just system to withhold income tax from individuals. Its tax system is progressive, employing rates dependent on the scale of the income. This regulation is applied universally

- With earning under EC $24.000 (which, approximately, amounts to US $8,880), a rate of 10% is applied.

- Once this amount is exceeded, the rate rises to 28%.

For foreigners earning income from Grenada residents, an individual rate of 15% is used. The relevant types of income include interest, dividends, and royalties.

Tax policies in place for businesses

A business operating domestically is paying the corporate tax of 28% accrued against its net profit. If a company is registered within the country, it is also subject to pay the tax what it earns outside the country. Non-resident businesses are obligated to do it only when the income is sourced from within Grenada.

A differential approach in real estate

Real property tax: Property tax is assessed on the market value of real property and ranges from 0% to 0.5%, depending on the property’s use. There is a rate for land and a separate rate for buildings. An exemption of XCD 100,000 is provided on the building value of owner-occupied property; however, only one property per taxpayer can be granted the exemption.

Grenada is known for its loyal approach to managing taxes on real estate. The tax base in this case is the market value of specific property. These values are defined for each specific piece of property by the Internal Revenue Department (IRD). The rate values also depend on types of property. The applicable differential ranges are listed below:

- Properties estimated below a certain margin are not taxed at all;

- Properties in the medium price range are rated at 0.5 %;

- The most expensive real estate installations must pay 0.8 % annually.

Moreover, the government is offering various benefits and lower rates to drive investment into specific areas of the economy.

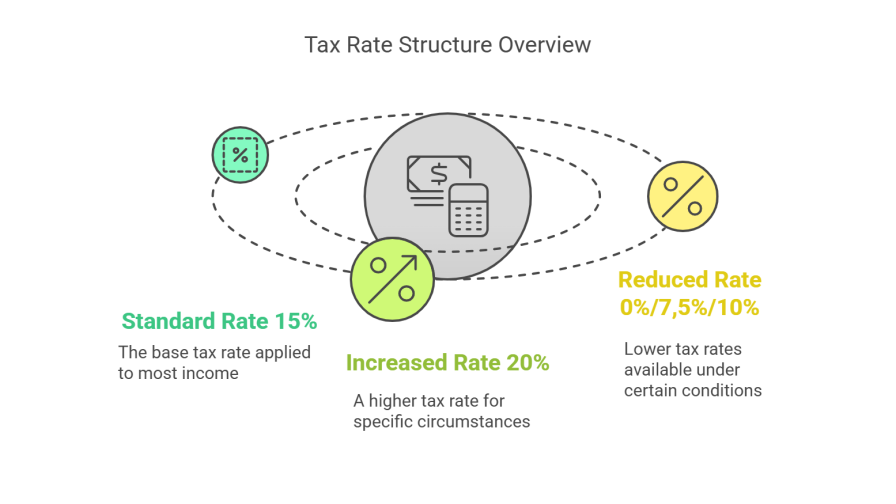

Taxation of added value

The country utilizes the VAT system for products and services produced or rendered domestically. The associated percentages withheld are differentiated based on their types:

- This type of tax is not charged against vitally or socially important products and services, such as foods, drugs, and education. Moreover, it is charged at zero percent on goods being exported to other countries.

- Telecommunications services, such a cable TV, Internet, and mobile communications are paying at the rate of 20%;

- Tourism holds key importance in Grenada, therefore the relevant industry services are charged at 10%. This relates to hospitality services, hotel accommodations, and restaurants, as well as recreation utilities, car rentals, taxi, and so on.

- The base rate for goods and services outside of the mentioned scopes is fixed at 15%.

The Grenada VAT system is geared to stimulate exports to drive more capital. The lower rates are applied in key industries to facilitate their further development. A zero rate on socially important goods and services help maintain steady conditions in vitally important areas.

Revenue obligations of domestic and foreign taxpayers

The balanced system in place is designed to offer unique incentives to both the locals and foreigners.

- As noted previously, the taxation system in place is of the territorial type. Both the categories of taxpayers are charged only against what they earn within the country. The only exception is profits earned by businesses registered locally, who are taxed at 28% on their worldwide income.

- All dividends, royalties, or interest paid by a local to a non-resident are subject to withholding of 15% of the payable amount. These amounts are paid at sourcing, which means they are withheld before the remaining funds are paid to the receiver. However this type of tax is not withheld when the amounts are received by a local from another local person or entity.

A soft taxation regime imposed on all taxpayer categories results in a comfortable business climate. Grenada is a very welcoming place to live, work, and invest in for everybody, regardless of origin.

International taxation agreements

Agreements in this regard are made up in order to avoid double taxation, ensure exchange of information, and facilitate cooperation between different countries.

- The UK and Grenada have entered into an agreement to avoid double taxation since 1949 (amended in 1968). This document establishes the principles used to avoid double taxation of incomes for the two countries.

- Grenada is a member to a multilateral agreement between the countries of the Caribbean Community (CARICOM). This treaty creates an economic union between Eastern Caribbean countries, along with a common currency, and removes double taxation while granting tax benefits to its citizens.

- Since 2012, the United Kingdom of Great Britain and Northern Ireland and Grenada have entered an accord to exchange information on taxation matters.

- Grenada is a participant in a multilateral OECD convention on mutual aid in taxation administration issues. This convention presumes expansion of international cooperation and prevention of tax evasion practices.

- Common reporting standard. Grenada has signed a multilateral international agreement on information exchange on financing funds between tax authorities of different states in compliance with the CRS.

Foreign investment

The state government is striving to establish a welcoming climate for investment. The taxation system provides a number of benefits and preferences to drive capital into the country.

A key factor driving foreign investment is absence of tax on income obtained by a non-citizen outside Grenada. Also, these factors contribute to creating the appeal:

- Foreign capital is completely free from gains taxation, which attracts long term investment.

- Nothing is withheld in case of property or assets inheritance, thus making it simple to transfer these to future generations.

- No fiscal charges are imposed on wealth: Grenada does subject the full value of property to taxation, regardless how great;

- When assets or funds change their owner as a gift, there are no withholdings either.

- Foreigners deriving their income from within Grenada pay a fixed 15% tax, which makes investment profitable and simple.

- Some companies and projects, especially those facilitating tourists and hospitality, may enjoy their fiscal benefits up to 20 years on, which facilitates growth and infrastructure development.

- Absence of Grenada property tax for those engaged in the program to obtain citizenship through investment: Despite the yearly duty to pay tax on property, foreign investors partaking in this program are freed from the 10% duty for the foreign land owner license when buying property.

Many of these benefits are in force for locals and foreigners. However it’s no doubt that these create an incentive for foreign businesses. After people spend 183 days inside Grenada, it becomes easy for them to opt in to become a local.

Grenada and the USA: the consequences of FATCA

From 2010, the state has reached an accord with the USA to ensure compliance with the US law called FATCA. This law ensures US citizens are prevented from tax evasion by utilizing foreign accounts. This accord ensures the following:

- Banks and financial organizations in Grenada are required to report accounts of US citizens to the IRS. This information helps track the income of US citizens gained from outside their homeland.

- In turn, the American government has agreed not to withhold payables under sections 1471 and 1472 of the US IRC in relation to Grenada accounts, provided that the data on mala fide US account owners is passed to the IRS. This has tasked Grenada with the necessity to provide most accurate information.

- This accord supports tax evasion prevention by facilitating financial information swapping and ensuring transparency.

Despite the fact that FATCA is key in taxation information exchange, it cannot be used to resolve all issues related to double taxation. Persons and entities operating in both these jurisdictions are highly recommended to consult the appropriate experts to ensure compliance with that regard.

FAQ

As a rule, if you hold the residency, your income is subject to this even when obtained elsewhere in the world. However, personal revenue is not taxable to the government. At the same time, you still have to report your gains if sourced within Grenada.

This type of tax is not withheld. It means you may add to your resources by selling your assets, such as property or shares, without having to pay anything.

Yes, the land is offering a set of benefits to welcome investment from the outside. One of the best known incentives offers many preferences to those seeking to invest and naturalize here, granting the investor a wide range of benefits, including personal freedom from income, capital gains taxes, and lower rates on property transfers.